What will happen on November 14

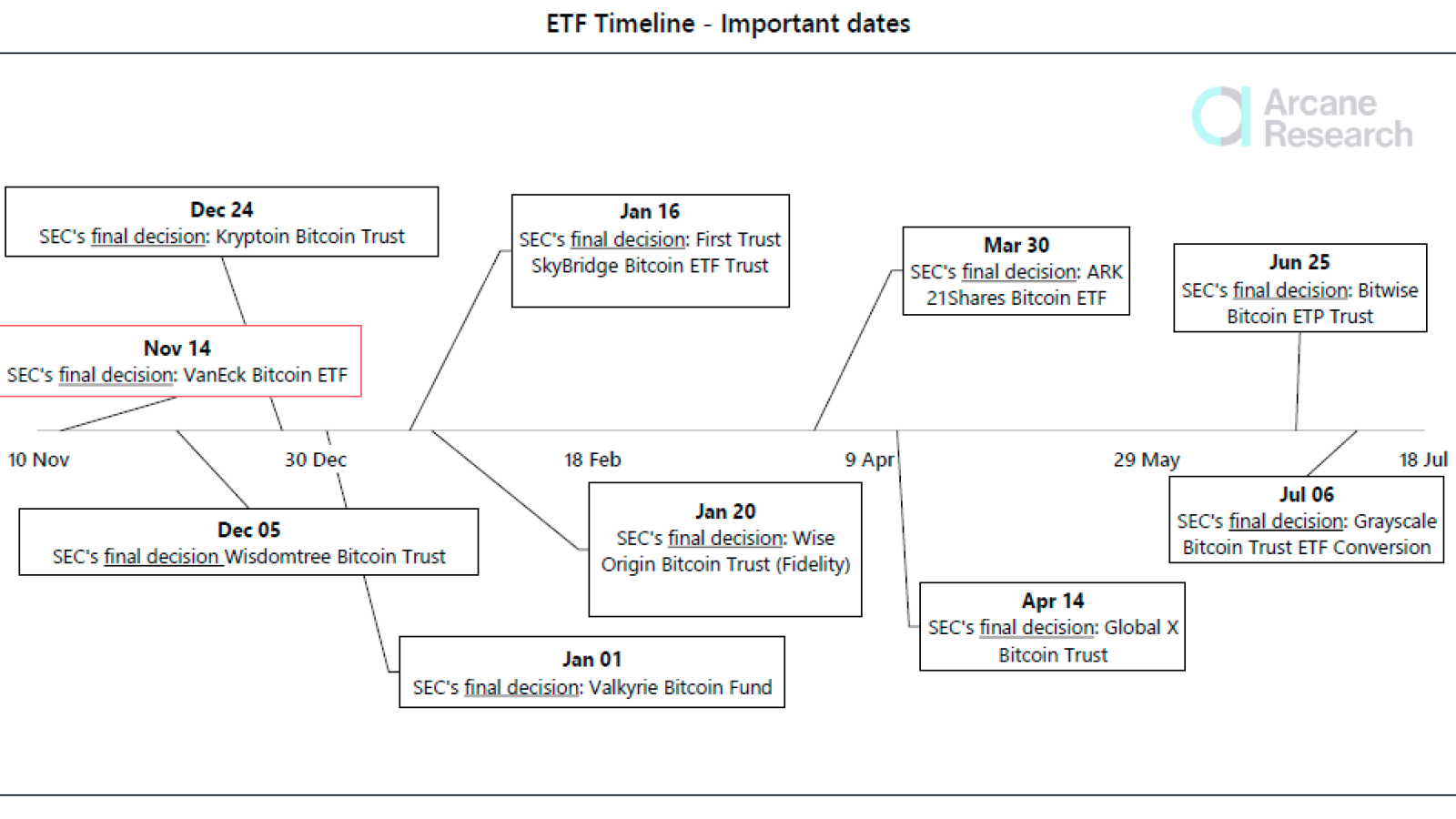

On Nov. 14, the Securities and Exchange Commission of the U.S. will give the industry its final decision on the approval or disapproval of the first physically-backed Bitcoin ETF in the U.S.

The approval of the new fund will be another step toward mass adoption and the creation of exposure for institutional investors without additional rolling costs and issues that are currently tied to the existing futures-based ETFs.

The main difference between current ETFs and VanEck’s product

The key difference between the two financial products is the type of exposure that they give. For example, ProShares’ product gives investors exposure to Bitcoin futures rather than Bitcoin itself, while VanEck’s product is designed for physical exposure.Related$140 Million XRP Moved Between Wallets While Someone Purchases 14 Million Coins from Binance

By buying the VanEck shares, investors would be able to expose themselves to Bitcoin directly without losing a significant part of their potential profits due to high roll costs and contango bleed.

What are the chances of approval?

Unfortunately, the SEC’s sentiment toward physical cryptocurrency ETFs has been loud and clear: the commission will not approve any products with underlying assets that they cannot control.

Due to Bitcoin trading being almost completely decentralized, the commission currently cannot directly control the trading process—thus protecting the country’s citizens from possible market manipulations.